Financial Technology, widely known by the moniker ‘FinTech’, is the application of technology in delivering financial products and services to clients or customers. While technology on its own was nothing new to the world of financial assistance — as the institutions used it at the back end of their operations, the advent of the internet in the early 1990s sparked a revolution within the industry.

A decade later, the arrival and widespread use of internet-enabled mobile devices such as Palm PCs accelerated the revolution into a boom. Now, with smartphones and tablets, the reality is that traditional financial services have been disrupted by technology. Today, you can make mobile payments and money transfers, access loans and raise funds, and manage your assets from a mobile device — miles away from a banking hall or an institution’s service centre. That is FinTech in Ghana at a cursory glance.

However, FinTech would involve more than just smartphones and the internet to thrive. Someone or some group of persons have to build systems to function in a manner that facilitates services for both clients and providers. Right? To this end, companies came into being; to produce the software and applications — necessary platforms on which the financial technology industry is built.

In this article, we’ll focus on the financial technology landscape of Ghana, looking at the beginning to the present and a peek into the plans for a cashless economy — from the high table.

An overview of Fintech in Ghana

As noted earlier, FinTech goes beyond the payment systems and services with which the customer directly interacts. However, since modern banking could not have existed in the first place without back-end technologies, we’ll ‘ignore’ that and direct the focus of this article toward customer-oriented services — even looking at firms operating from outside the traditional finance sector.

Sika Card

Ghana’s contribution to FinTech began in 1997 when the Social Security Bank (SSB) introduced the ‘Sika Card’ into the Ghanaian banking sector. Its purpose was to eliminate the use of large sums of money for transactions. Being the first of its kind in the country, the smart card served as an alternative to banknotes and cheques – enabling holders (both customers and non-account operators of SSB) to conduct cashless transactions with each other and the bank.

Today, while the bank, which is the 5th largest in the country, has rebranded as Société Générale (formerly SG-SSB), it continues to offer innovation — while further investing in online banking.

E-zwich Smart Card

In April 2008, ten years after the Sika Card, the government of Ghana under President John Agyekum Kuffour launched the E-zwich smart card — as a national smart payment system. The interoperability of the e-zwich system offered banks, savings and loans companies, and other deposit-taking institutions a platform to operate.

Because of the large network of banks and financial institutions where E-zwich transactions can be performed, it is currently the only smart card in Ghana whose users enjoy the convenience of nationwide access to the service. Also, it is the most secure system, as transactions need biometric data (fingerprints) before getting authenticated. A lesser-known fact about the E-zwich is that it marked the introduction of biometric banking worldwide.

As noted earlier, FinTech is not to be limited to payment platforms and systems only. For example, requesting and receiving a bank statement on your desktop computer or mobile device is possible due to fintech. Today, it is common for banks to have mobile apps with which customers can make checks and enquiries and find out information on products relating to their bank accounts.

Mobile Money and Other Mobile e-Wallets

In 2009, telecom giant MTN introduced Mobile Money onto the Ghanaian payments landscape. It was an ingenious way to rein the unbanked into the formal sector; it didn’t take long for the service to catch on with people. It was a fast, convenient, and affordable way to make payments, transfer money, and conduct other transactions simply with one’s mobile phone number.

As of December 2018, the number of Mobile Money accounts was 32 million, representing a 17.43 per cent jump from 23.9 million registered accounts in 2017. However, only 13 million accounts were active as of December 2018.

MTN’s Mobile Money proved so successful with people that the years followed saw the other telecom operators — Airtel (Airtel Money) and Tigo (Tigo Cash) securing a foothold within that space for themselves. The two have since merged to form AirtelTigo. The last to join their ranks as Vodafone, who in 2015 launched the M-Pesa service in Ghana — under the Vodafone Cash brand name.

The e-wallets did not become successful without challenges, however. The telcos had to bear the cost of developing the infrastructure, awareness, and expansion drives. But the challenges notwithstanding, mobile e-wallets have established themselves as major players in the present and future of Ghana’s financial services industry.

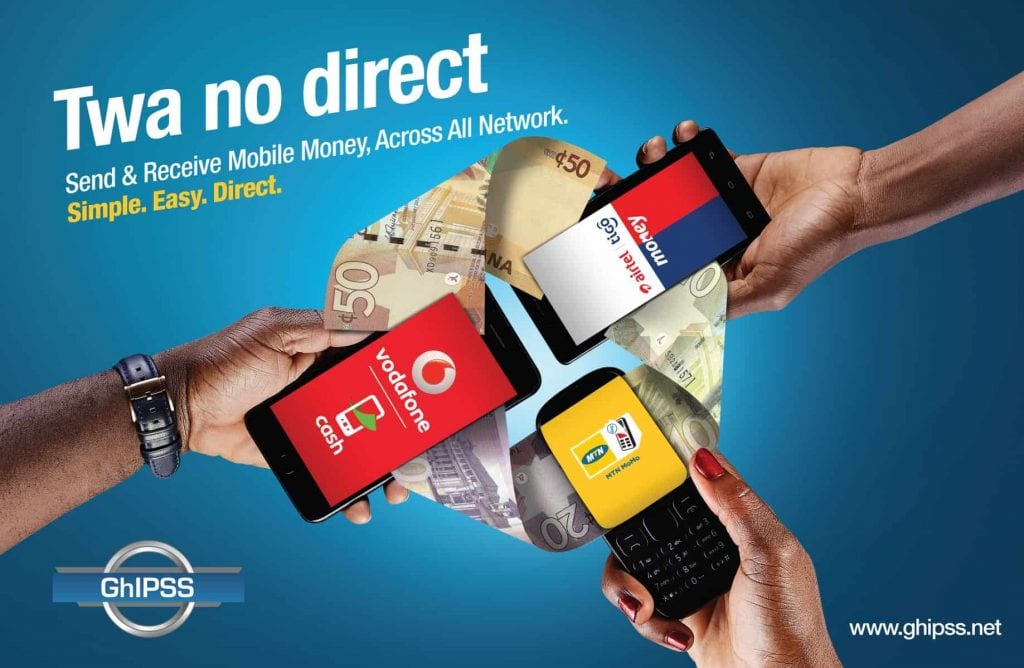

In May of 2018, the mobile money interoperability system was launched. At its full implementation, the service made transferring funds between mobile wallets within and across networks easier. That aside, it allows the movement of funds between one’s bank account and mobile e-wallet, giving the user 24/7 access.

Before the introduction of the mobile money interoperability system, there was MOVE, the USSD-based platform (*718#) that allowed users to send money and pay bills directly from their mobile wallets.

Other Payment Platforms

Aside from the banks and telcos impacting the financial sector with innovative services, there are several indigenous firms whose main focus is on providing value through innovative financial technology. In the next few paragraphs, we’ll learn about these firms and what unique feature sets each apart from others in the category.

expessPay

expressPay is that one payment gateway provider that does it all. From paying for subscription TV services (DSTv, GoTv, etc.) to buying airtime from all the telcos in the country, paying school fees, and booking hotel rooms — expressPay does it all in real-time.

Aside from supporting all card networks (Visa, Mastercard, American Express, etc.) and mobile money services, expressPay is an official Visa Payment Technology Provider (PTP). And it is a very secure system as it meets all the international security standards and is PCI DSS certified.

Slydepay

One cool thing about Slydepay is that it allows you to send money from your bank-issued credit or debit card to any network’s Mobile Money wallet, even if you don’t have a mobile wallet.

Slydepay makes it easy for you to pay for services rendered by making deposits into the receiver’s mobile money account. Also, through this platform, you can pay school fees and utility bills and contribute toward organisational funds or dues.

You can also use the service to purchase airtime and data bundles from all the telecom providers and replenish your Busy and Surfline internet accounts.

Slydepay assists with bulk transfers, bulk purchases, and the processing of transactions for businesses and merchants. Let’s assume you operate a restaurant; now, half of your customers prefer to pay with mobile money and cards. That would present you with a problem tracking mobile money payments for all three mobile money wallets of the three telcos. To solve this, Slydepay provides you with a USSD code, Mobile Money POS or QR code to sort out all your mobile money payments on one platform. There are no extra phones or long queues; rather, more cash for your business.

Hubtel

Hubtel started in 2005 as a non-telco SMS gateway provider (SMS Gh). Today, after more than 14 years of innovation, its mobile value-added aggregation and payments platform is widely regarded as an industry leader among its contemporaries.

Merchants with WordPress websites can add Hubtel Payments to their website through the Woocommerce payment gateway. This enables them to receive payments from clients through their bank cards (Master Card and Visa) or mobile money. Currently, it is the only FinTech with a rewards system that gives back to clients when they pay for goods and services; using the platform.

Also existing within this category are ALEXpay, PalmPay, FlexiPay, Mazzuma, ZeePay, etc., which are just a few of the newer payment platforms which will individually be covered in subsequent articles.

Impact

Without a doubt, the presence of payment platforms such as those noted earlier has positively impacted and disrupted how business is conducted in Ghana. Among the lot, Mobile Money is the most commonly used payment option for many customers and service providers.

The e-commerce sector of Ghana’s trade industry is expanding mainly due to such platforms that make it easy to make payments that hitherto had to be done with cash. For example, although many businesses were listed online in the past, you couldn’t make upfront payments without physically being at a showroom or shop. Now, you can log on to a vendor’s app or website with a few taps on your smartphone screen.

With less money being carried around, one has the assurance that the likelihood of losing large sums in the event of a mugging or armed attack is less or nonexistent. In that sense, one can say that there’s been an improvement in general security to an extent.

Progress

As Ghana goes digital with her economy, one significant step that has been taken towards further liberalising the country’s payment system is the passage of the Payment Systems and Services Act earlier in March 2019 to regulate institutions that provide payment services as well as electronic money business and related issues.

The Act, which would allow for the entry of non-banks and enable direct licensing of FinTechs by the Bank of Ghana, is part of the regulatory institution’s broader strategy for creating an enabling environment that would facilitate retail payments and funds transfer mechanisms that are efficient and safe.

Also, the availability and relative ease of access to Mobile Money APIs make it easier to do FinTech-related business in Ghana — compared to some African countries, getting access to these APIs is not easy.

Challenges

While Ghana’s financial technology sector can be considered vibrant in the various platforms available, it is still quite some distance away from being considered a major participant on the continent. This is not only about the number of active service providers but also how accepted some platforms are in international transactions.

Mobile wallets (Mobile Money) are the most commonly used such that even non-bank payment platforms have these services integrated into their systems as part of the available options. The major challenge posed by this is the rampant fraud cases perpetrated by some mobile wallet users. While some platforms can monitor and mitigate the risk of fraud, it’s hard to trace the perpetrators of such fraudulent activities as many people’s wallets are tied to false credentials.

One of the ultimate aims of FinTech is to bring the unbanked into the formal sector by enabling financial inclusion. For this reason, Ghana’s platforms and systems must evolve and attain the standard where people can complete payments on major international platforms without necessarily having to put their bank or credit card information into an e-commerce service provider’s billing system.

Another occasional drawback happens when networks or systems experience ‘downtime’ just as a transaction is being worked on. When such inconveniences happen, one is sometimes forced to forgo the purchase as time may not be an ally at that moment.

Understandably, systems experience glitches from time to time. However, service needs to be restored as quickly as possible. Many vendors lose sales when customers forgo a purchase because of such inconvenient situations. FinTech is meant to make things easier, not complicate them further.

Future Possibilities

While most goods and services can be paid for using smart cards and e-wallets, one market that is still left untapped is the transport sector. As it is now, most transport payments are made by cash transactions. For a country aspiring to attain a cash-lite economy, this is not something to be brushed aside.

Digitising the transport sector would make it easier to regulate fares — something that causes contention between commuters and vehicle operators. Also, it would enable regulatory bodies to restrict or identify vehicles with a particular route — making it easier to track them when needed.

The expectation is for a simple system to be developed through which commuters will get their transport fares sorted out without involving cash. When this happens, it’ll eliminate the delays and anxiety experienced by passengers when the driver or his mate (conductor) does not have enough change at hand for commuters.

In Conclusion

While Ghana cannot be considered young when FinTech is being discussed, it still has a long way to go — with the service providers (platforms) and the end-user. For example, some respondents to a survey touched on issues relating to competitive rates and the amounts that must be paid to keep a mobile money service running. The complaint was that ‘fledgling’ companies who own mobile money apps do not retain any money. This is an issue the regulatory body must address to help create a friendly or favourable environment for companies to operate within.

People are moving away from cards and gravitating more towards completing transactions on their smartphones. Thus the GhIPSS Instant Pay (GIP) service, which allows payments to electronically be sent across financial institutions from one bank account to the other as a single immediate payment, is a welcome innovation.

The FinTech landscape changes to suit people’s needs. Innovation is the way to stay relevant within this space. Hopefully, while the various platforms compete to dominate the area, they won’t forget to collaborate on important issues, especially regarding security.

Are you enjoying your time on JBKlutse?

Articles like these are sponsored free for everyone through the support of generous readers just like you. Thanks to their partnership in our mission, we reach more than 50,000 unique users monthly!

Please help us continue to bring the tech narrative to people everywhere through relevant and simple tech news, reviews, buying guides, and more.

Support JBKkutse with a gift today!