According to S&P Global Market Intelligence study, the key factors influencing bank selection are as follows (respondents were given multiple choices):

- better mobile banking app experience (38.7%),

- enhanced customer service (37.9%),

- lower fees (30.5%),

- improved branch network in a given area (26.1%),

- extended opening hours (25.9%),

- change in living situation (e.g. moving, getting married/divorcing) (25.7%),

- higher interest rates on deposits (24.6%),

- incentive offer (23.8%),

- other (6.6%).

Considering the above aspects, banks should follow below listed options to stay competitive:

- Building a new mobile banking app from scratch, if necessary.

- Revamping their existing mobile banking app, among other things, to meet current market standards and deliver a more user-friendly experience.

- Incorporating low-code/no-code platforms to accelerate the application development process.

- Implementing virtual branches to their digital banking offer, which would improve customer service, address the problem of a lack of physical branches in certain areas, and provide customers with 24/7 access to bank accounts.

Suppose you are thinking of enhancing or building a new mobile banking app to eliminate bugs, improve efficiency, increase user satisfaction and improve in-store ratings. In that case you have to choose a proven partner.

Finanteq has been pursuing a digital-first approach (previously as eLeader) for almost two decades, and it has become expert in the field. Our strong focus on the banking sector and mobile app development has enabled us to reach remarkable technical excellence and operational effectiveness.

Finanteq’s approach to mobile banking app development

While cooperating with our clients, we pay utmost attention to their needs and their target customer groups’ demands.

We are not a typical outsourcing company, but a trustworthy partner that becomes part of the company’s structure, ready to suggest the best options for the bank.

Our customers appreciate the way we work.

The reviews on @Finanteq’s profile on Clutch are the most robust evidence for this:

- “Finanteq is an excellent development partner that supports the customers’ full digital banking experience through the app.” – Executive Manager & Program Manager, National Bank of Kuwait

- “FINANTEQ works efficiently, delivering reliable services without compromising quality.” – Product Manager, mBank

How do we streamline our work?

- We provide custom app development that meets the exact bank’s needs and specifications using our ready-to-integrate components and tools.

- We help banks to create and implement applications efficiently while maintaining maximum business value, with a short time-to-market and without exceeding the budget, thanks to the availability of numerous tools, off-the-shelf libraries, and innovative products.

- We assure our customers dedicated high-performing teams of mobile banking developers, project managers, scrum masters, product owners, business analysts, and testers. Our teams are available to join any project at any stage, ensuring seamless integration and timely delivery.

- We aim for 100% coverage of our code with automated functional tests. We also achieved short regression testing time: up to 20 minutes for an average application, drastically improving time-to-market and reducing costs.

- We consistently automate repetitive and monotonous processes.

Whether you plan to build an application from scratch or revamp an existing one, you are assured of the best resource allocation with us. With Finanteq, you save time and money, and the final product always delights.

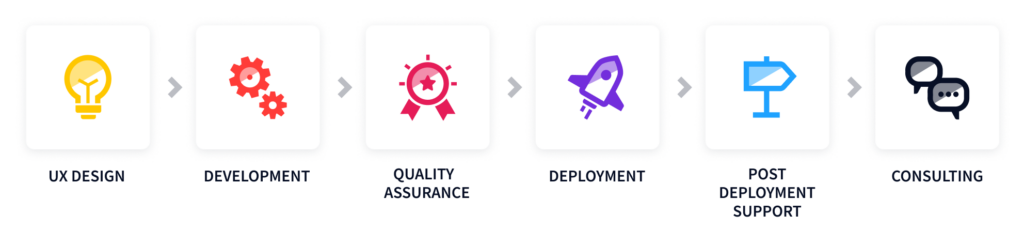

What is worth mentioning here, we offer end-to-end project delivery, including consulting, UX design, and publishing the final application on App Store and Google Play.

Thanks to our extensive experience in mobile banking app development, we not only support our customers with app development, but we furthermore help them achieve all goals and beyond (also thanks to our products).

No-code tool for banking – Journey into the Future of Software Development

At Finanteq, we have created a solution, so that the banking industry can reap all the benefits that no-code provides. Unlike many other no-code/low-code tools available in the market, our – Extentum meet all unique industry requirements.

Extentum stands out as a specialized platform that allows extending existing banking applications. Its unique purpose is to seamlessly integrate with the bank’s current applications, whether it is iOS, Android, or web platforms. This makes Extentum an ideal choice for banks looking to enhance and expand their operating digital channels faster and without developers’ engagement.

Our tool simplifies the implementation of commonly used services in banks, using configurable business logic. With the no-code platform deployed to the bank’s remote channels, non-IT professionals, i.e. business analysts can easily and quickly introduce the new functionality without having to release a following version of the application.

Few example uses of Extentum:

- loan offer,

- applying for a mortgage,

- blocking a card,

- selling an insurance,

- offering a deposit based on data obtained from another bank.

Using a no-code platform saves time and money. Time, because, as mentioned, it allows faster production availability of functionalities that in the classic development model would be realized much later. Programmers do not have to be employed to code basic functionalities and their skills can be used mostly for challenging tasks. Moreover, the combination of these aspects results in significant cost savings.

Extentum is a perfect tool to support application development. To learn about its potential, make an appointment for a demo.

Virtual Branch – Support for primary customer needs

Not only excellent application does influence bank selection but also gains customers’ loyalty. The research cited in the introduction also showed three equally important areas for bank customers: better customer service, better branch network in their area and better opening hours.

The best and fastest solution to address those needs is a virtual branch embedded into the bank’s existing web and mobile applications.

At Finanteq, we have created Pocket Branch – a remote channel that allows bank customers to access the service 24/7 from anywhere.

Pocket Branch enables banks to achieve three goals: improve sales, provide better service, and assist their customers if needed. At Finanteq, we know that human contact is significant when decisions involve more complicated issues, such as investments or mortgages. The accessibility of a bank advisor via audio, video, or chat, without having to visit brick-and-mortar branch, can also be particularly appreciated by individuals with mobility challenges, hearing impairments, or other disabilities.

When creating digital banking, ensuring top-notch customer service through all available channels is vitally important. Creating our solutions, we aim to provide the best CX, which translates into achieving banks’ business goals, such as increasing sales, retaining and attracting users better than competitors.

Trust mobile banking experts

Developing a mobile banking application is a complex process, but with the competent partner, bank can create the tailor-made solution right away.

As mentioned earlier, Finanteq has extensive experience in banking industry. We ran number of banking projects worldwide and our customers value our expertise.

So, if you want to build a new app from the scratch – our teams are ready to start the project immediately and ensure end-to-end project delivery.

Notably, if you need support with your current banking app – we are ready to make fast project evaluation, as well as suggest improvements and key areas for the further development.

Last but not least, banks can use our off-the-shelf products and components and expand their banking applications even faster and better.

Do not hesitate. Contact us now and build a custom product you need: https://finanteq.com/

Author: Agnieszka Torój, Marketing Specialist, FINANTEQ S.A.

Are you enjoying your time on JBKlutse?

Articles like these are sponsored free for everyone through the support of generous readers just like you. Thanks to their partnership in our mission, we reach more than 50,000 unique users monthly!

Please help us continue to bring the tech narrative to people everywhere through relevant and simple tech news, reviews, buying guides, and more.

Support JBKkutse with a gift today!